CFP CERT TM Professional Full Financial Planning Services

📌 CFP Malaysia Framework (6 Key Areas)

According to CFP Board & FPAM Malaysia, comprehensive financial planning usually covers:

- Cash Flow & Debt Management

- Investment Planning

- Retirement Planning

- Tax Planning

- Risk & Insurance Planning

- Estate Planning & Wealth Transfer

Full Financial Planning Services

(CFP CERT TM Professional — Malaysia)

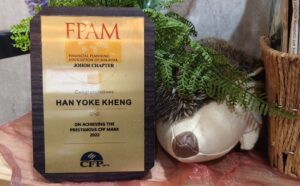

As a CFP CERT TM Professional based in Johor Bahru, Amanda Han provides comprehensive financial planning services tailored for Malaysian families and working professionals. Whether you are preparing for retirement, funding your children’s education, or building a sustainable investment portfolio, every plan is designed to balance today’s lifestyle with tomorrow’s financial security.

1. Cash Flow & Debt Management

- Review of income, expenses, and savings habits.

- Strategies to reduce unnecessary debt and build healthy saving discipline.

- Emergency fund planning for at least 6–12 months.

2. Investment Planning

- Portfolio design using Public Mutual unit trust funds.

- Risk profiling to match your personal goals (growth, income, or balanced).

- Ongoing monitoring to stay aligned with market trends.

3. Retirement Planning

- Projection of your retirement needs beyond EPF savings.

- Private Retirement Scheme (PRS) strategies to enjoy tax relief.

- Long-term wealth accumulation for a comfortable lifestyle in retirement.

4. Tax Planning

- Maximize reliefs under the Malaysian Income Tax Act.

- Optimize PRS, insurance, and education savings for yearly deductions.

- Structuring of family or business assets to reduce future tax burdens.

5. Risk & Insurance Planning

- Protection review for life, medical, disability, and critical illness.

- Integration of free protection features in selected Public Mutual funds (e.g., Mutual Gold).

- Ensure your family is financially secure in the event of uncertainties.

6. Estate & Wealth Transfer

- Will writing and trust planning for family security.

- Strategies for smooth inheritance distribution.

- Protect children’s education and living expenses if the unexpected happens.

Special Add-Ons

✅ Education Fund Planning – Build a tertiary education fund for your child locally or overseas.

✅ Parent-Child Financial Literacy – Practical methods to raise money-wise children through daily habits.

✅ Business Continuity Planning – Protect and grow your business while ensuring smooth succession.

📞 Work With Amanda

With over 10 years of financial advisory experience and serving 400+ clients, Amanda Han integrates practical financial solutions with real family needs.

👉 Whether you’re planning for retirement, considering unit trust investments, or exploring a career as a Unit Trust Consultant, Amanda can guide you step by step.

📌 Contact Amanda Here | WhatsApp Amanda

Comfortable Retirement

a plan to supplement your EPF and other pension funds to help maintain your current lifestyle during your retirement years

Children’s Tertiary Education

a plan to pay your children’s education costs for undergraduate studies or comparable vocational training

Dream Home

a plan to help you realize your dream of a home for you and your family.

Tax Planning

a strategy to reduce your income tax burdens by proper structuring of your employment benefits, and to optimize your claims for business expenses

Business Ownership and Continuation

a plan to start and own a business and to ensure the business is a going concern

Family Security in case if Untimely Death/Disability

a plan to help meet your financial obligations and assure your family of financial security in the event of your premature death/disability

Wealth Accumulation and Distribution

a plan to accumulate wealth and an arrangement to preserve assets, and in passing on your estate to your loved one

Health Assurance

a plan to ensure adequate funds and protection to meet medical fees, including hospital bills and long-term care for yourself and your family

Other Financial Objectives

a plan to help you realize your other financial goals like owning your luxury house, or car, traveling overseas, vacation, charity contributions, and others.